This balance has declined versus the prior year primarily due to cash repatriations following the enactment of the U. The primary drivers of changes in gross margin are input costs energy and other commodities , pricing impacts, geographic mix for example, gross margins in developed markets are generally higher than in developing markets for similar products , product mix for example, the Beauty segment has higher gross margins than the Company average , foreign exchange rate fluctuations in situations where certain input costs may be tied to a different functional currency than the. Proceeds from Divestitures and Other Asset Sales. We use raw materials that are subject to price volatility caused by weather, supply conditions, political and economic variables and other unpredictable factors. In personal health care, we are a top ten competitor in a large, highly fragmented industry, primarily behind respiratory treatments Vicks brand , non-prescription heartburn medications Prilosec OTC brand and digestive wellness products Metamucil, Pepto Bismol and Align brands. Core EPS growth of mid-to-high single digits; and. June Gross margin increased due to productivity cost savings, partially offset by unfavorable geographic mix driven by the disproportionate growth of developing regions, which have lower than segment-average margins. Sales are recorded net of trade promotion spending, which is recognized as incurred, generally at the time of the sale. We use our research and development and consumer insights to provide superior products and packaging. Tax Act caused a basis-point increase in the current period rate see Note 5 to the Consolidated Financial Statements for further discussion. We evaluate our tax positions and establish liabilities in accordance with the applicable accounting guidance on uncertainty in income taxes. For our international plans, the discount rates are set by benchmarking against investment grade corporate bonds rated AA or better. The decrease was primarily driven by the decrease in operating cash flows.

In addition, we have agreements with a diverse group of financial institutions that, if needed, should provide sufficient credit funding to meet short-term financing requirements. December We work collaboratively with our customers to deliver superior retail execution, both in-store and online. This includes service contracts for information technology, human resources management and facilities management activities that have been outsourced. A core operating principle is that our tax structure is based on our business operating model, such that profits are earned in line with the business substance and functions of the various legal entities. Juan Fernando Posada. While the amounts listed represent contractual obligations, we do not believe it is likely that the full contractual amount would be paid if the underlying contracts were canceled prior to maturity. Personal Health Care organic sales increased low single digits driven by higher shipments and increased pricing.

{{year}} Annual Report and Proxy Statement

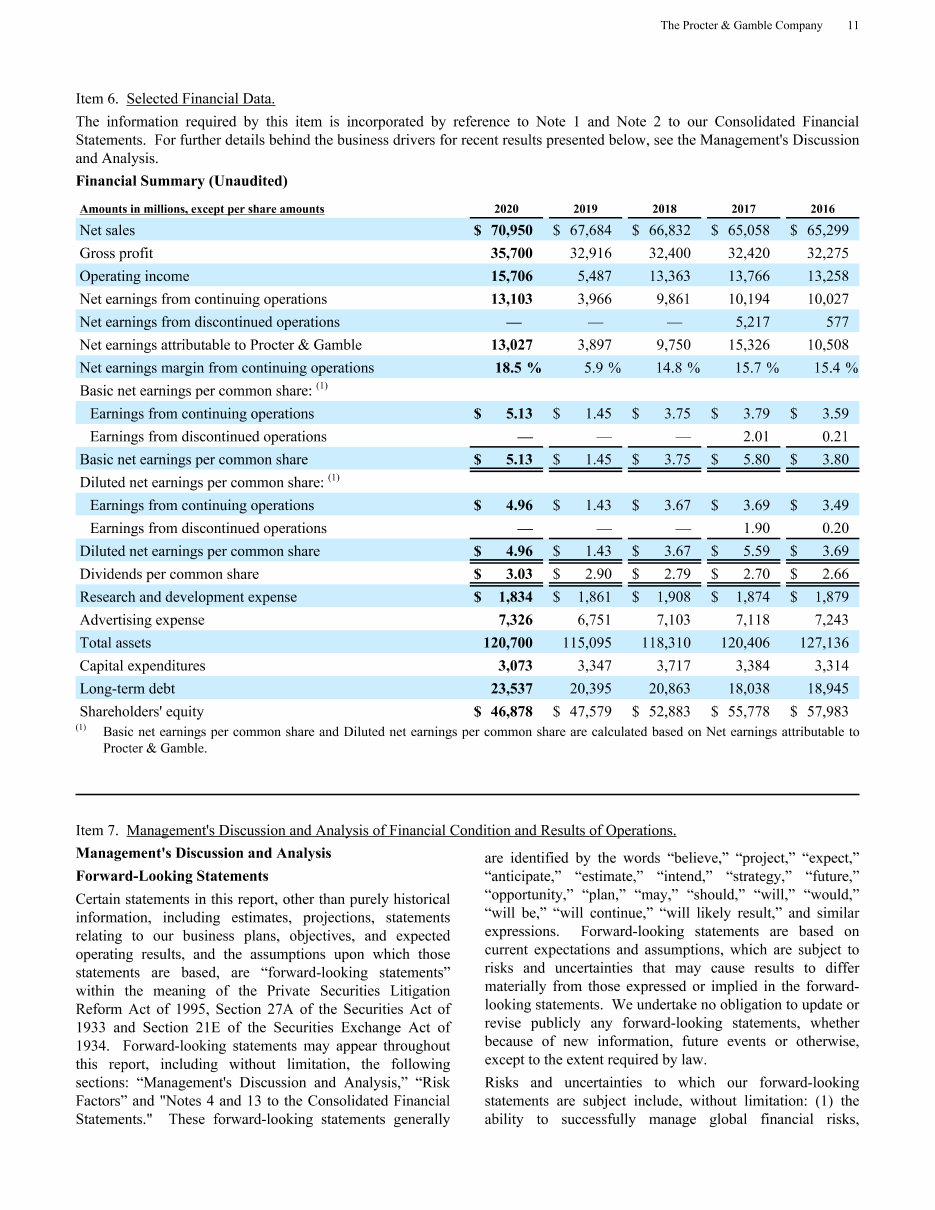

This impact includes both transactional charges and translational impacts from converting earnings from foreign subsidiaries to U. Other includes the sales mix impact from acquisitions and divestitures, the impact from India Goods and Services Tax implementation and rounding impacts necessary to reconcile volume to net sales. Earnings from continuing operations before income taxes. Tax Act and an increase in the proportion of corporate overhead spending allocated to the segments. Our success is dependent on identifying, developing and retaining key employees to provide uninterrupted leadership and direction for our business. Change in other operating assets and liabilities. Core gross margin declined basis points, including 40 basis points of negative foreign exchange impacts. Prepaid expenses and other current assets. Our GBUs are organized into ten product categories. Shareholder Return. Tax Act may differ from the estimates provided elsewhere in this report, possibly materially, due to, among other things, changes in interpretations of the U. Cash Flow.

Annual Reports | Procter & Gamble Investor Relations

- The plan was designed to accelerate cost reductions by streamlining management decision making, manufacturing and other work processes to fund the Company's growth strategy.

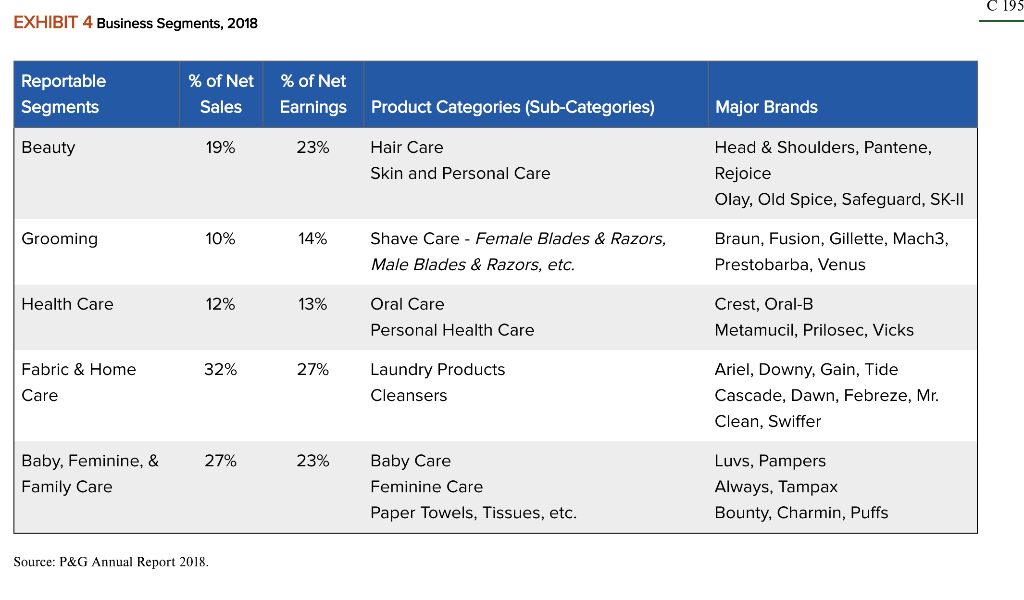

- Shave Care organic sales decreased low single digits due to investments to improve consumer and customer value, primarily in the North America region.

- Favorable product mix contributed.

- Management views these non-GAAP measures as a useful supplemental measure of Company performance over time.

- Such contractual purchase obligations are primarily purchase orders at fair value that are part of normal operations and are reflected in historical operating cash flow trends.

Washington, D. Form K. Mark one. For the Fiscal Year Ended June 30, For the transition period from to. Commission File No. Telephone State of Incorporation: Ohio. Securities registered pursuant to Section 12 b of the Act:. Title of each class. Name of each exchange on which registered. Common Stock, without Par Value. Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule of the Securities Act. Yes þ No o. Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15 d of the Act.

Organic sales increased one percent for the quarter driven by a three percent increase in organic shipment volume. Organic sales increased one percent for the year driven by a two percent increase in organic shipment volume. We are operating in a very dynamic environment affecting the cost of operations and consumer demand in our categories pampers financial statements 2018 against highly capable competitors. We will accelerate change in the organization and culture to meet these challenges. We will continue to drive cost and cash productivity improvements, and we will invest in the superiority of our products, packages and demand creation programs, pampers financial statements 2018. All of these efforts are aimed at delivering balanced top-line and bottom-line growth that creates shareholder value over the short, mid and long term. Organic sales increased one percent on a three percent increase in organic volume.

Pampers financial statements 2018. Annual Reports

.

.

We sell most of our pampers financial statements 2018 via retail customers, which include mass merchandisers, e-commerce, grocery stores, membership club stores, drug stores, department stores, distributors, wholesalers, baby stores, specialty beauty stores, high-frequency stores and pharmacies. Our assumptions reflect our historical experiences and management's best judgment regarding future expectations.

Tallinna Sadam webinar - presenting financial results of 6 months 2018

I consider, that you are mistaken. I can prove it.

I to you will remember it! I will pay off with you!

I am sorry, that has interfered... I understand this question. It is possible to discuss. Write here or in PM.